(Bloomberg) — Wall Street was poised to open steady on Tuesday as traders retreated to the sidelines ahead of results from Nvidia Corp. and speeches by a slew of Federal Reserve policymakers.

Most Read from Bloomberg

Palo Alto Networks Inc. was the biggest mover in premarket New York trading, sliding as much as 8.5% after the security software company issued a disappointing quarterly billings forecast. Futures on the S&P 500 and Nasdaq 100 traded mostly flat. Activity thinned out sharply on Monday, with daily turnover on the New York Stock Exchange at the lowest this year.

Never miss an episode. Follow The Big Take daily podcast today.

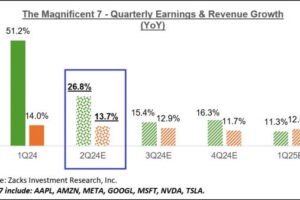

The main focus for markets is Wednesday’s results from artificial-intelligence bellwether Nvidia, which has powered a large chunk of the S&P 500’s recent earnings. Nvidia shares rose 2.5% in New York on Monday, sending the Nasdaq 100 index to another record high. Analysts estimate its sales grew 243% last quarter, but many fear the stock’s 90% advance this year leaves scope for disappointment.

Investors are also monitoring commodity prices, with the Bloomberg Commodity Spot Index near the highest level since January 2023, boosted by gold, silver and copper touching record peaks. The commodity surge has so far failed to derail conviction that inflation will keep easing, allowing the Federal Reserve and other major central banks to cut interest rates this year.

“The latest batch of growth, inflation, and Fed data has provided the macro support for the markets to keep grinding higher,” Jason Draho head of Americas tactical asset allocation at UBS Financial Services Inc., said in a note. “Nvidia’s 1Q24 earnings this week could boost the micro AI tailwind.”

Investors are on the alert for potential stumbling blocks after a blistering rally that’s lifted MSCI’s All-Country equity index almost 10% this year. Earnings aside, they are watching speeches later in the day from central bank officials, including Fed Governor Christopher Waller.

His comments – as well as Wednesday’s release of the latest Fed meeting minutes — will be closely monitored after Cleveland Fed President Loretta Mester suggested on Monday there was less scope for interest rate cuts than previously expected.

“Markets’ hesitation reflects the change in central bankers’ stance as they have gone from being openly willing to cut rates to calling for patience,” said Florian Ielpo, head of macro research at Lombard Odier Asset Management. “Sentiment is split, as higher rates can hit equities but it also means we are seeing better growth and earnings.”

In other markets, Bloomberg’s Dollar Spot Index traded flat, while bond yields were broadly lower. Crypto prices surged on signs of momentum toward US approval of exchange-traded funds investing directly in second-largest token Ether.

Europe’s Stoxx 600 index slipped 0.4%, with drugmaker GSK Plc among the losers as it faced a whistleblower lawsuit that could cost it billions of dollars.

Key events this week:

-

Fed’s Thomas Barkin, Christopher Waller, John Williams, Raphael Bostic, Susan Collins, Loretta Mester speak, Tuesday

-

US existing home sales, Wednesday

-

Fed minutes, Wednesday

-

Nvidia earnings, Wednesday

-

Eurozone S&P Global Services PMI, S&P Global Manufacturing PMI, consumer confidence, Thursday

-

G-7 finance meeting in Stresa, Italy, May 23-25

-

US new home sales, initial jobless claims, Thursday

-

Fed’s Raphael Bostic speaks, Thursday

-

US durable goods, University of Michigan consumer sentiment, Friday

-

Fed’s Christopher Waller speaks, Friday

Some of the main moves in markets:

Stocks

-

The Stoxx Europe 600 fell 0.4% as of 1:07 p.m. London time

-

S&P 500 futures were unchanged

-

Nasdaq 100 futures were little changed

-

Futures on the Dow Jones Industrial Average were little changed

-

The MSCI Asia Pacific Index fell 0.7%

-

The MSCI Emerging Markets Index fell 0.7%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0864

-

The Japanese yen was little changed at 156.34 per dollar

-

The offshore yuan was little changed at 7.2442 per dollar

-

The British pound was little changed at $1.2715

Cryptocurrencies

-

Bitcoin rose 2.4% to $71,194.82

-

Ether rose 7.8% to $3,775.75

Bonds

-

The yield on 10-year Treasuries declined one basis point to 4.43%

-

Germany’s 10-year yield was little changed at 2.53%

-

Britain’s 10-year yield declined one basis point to 4.15%

Commodities

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Tania Chen, Joanna Ossinger, Selcuk Gokoluk and Michael Msika.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Add Comment