(For a Reuters live blog on U.S., UK and European stock markets, click or type LIVE/ in a news window.)

*

Netflix falls after downbeat forecast

*

Abbott Labs, Intuitive Surgical jump after earnings

*

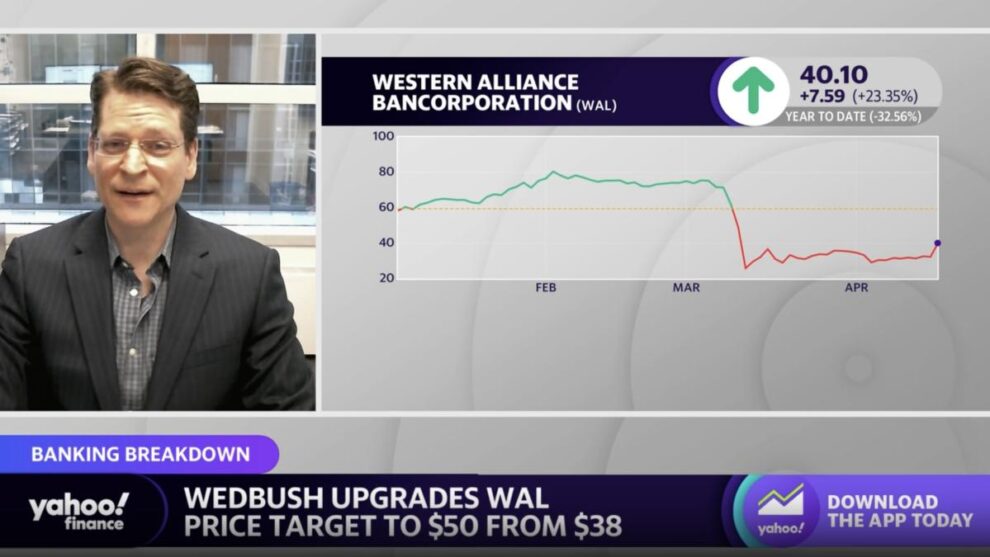

Western Alliance surges as results allay deposit fears

*

VIX falls to lowest since November 2021

(Updates with close of US market)

By Lewis Krauskopf, Sruthi Shankar and Ankika Biswas

April 19 (Reuters) – The S&P 500 ended little changed on Wednesday as investors digested a mixed bag of corporate earnings, including upbeat reports from medical technology companies, countered by weakness in Netflix shares.

The Dow slipped, weighed down by declines in Walt Disney Co and UnitedHealth Group Inc shares following results from rivals in their respective industries.

Major equity indexes have been largely stable during the early stages of a first-quarter earnings season that investors expect to show tepid results.

“Corporate results are being seen as being in large part company-specific news versus market news,” said Art Hogan, chief market strategist at B Riley Wealth. “If that keeps us relatively calm and unchanged for now, while the sample set of reporters is still quite small, I think that’s a positive.”

According to preliminary data, the S&P 500 lost 0.18 points, or 0.00%, to end at 4,154.69 points, while the Nasdaq Composite gained 4.08 points, or 0.03%, to 12,157.49. The Dow Jones Industrial Average fell 79.29 points, or 0.23%, to 33,898.92.

The CBOE Volatility index, also known as Wall Street’s fear gauge, fell to its lowest point since November 2021 during the session.

Investors are looking for signs in corporate results that inflation may be driving up costs or hurting consumer spending, amid fears the economy may be on the cusp of a downturn.

S&P 500 companies overall are expected to post a 4.8% decline in first-quarter earnings from the year-earlier period, according to Refinitiv IBES.

“We seem stuck in this range, with those people who think that there is going to be a recession coming and those people who think there is going to be a soft landing,” said Rick Meckler, partner at Cherry Lane Investments.

Netflix Inc shares slid after the video-streaming pioneer offered a lighter-than-expected forecast.

Shares of Elevance Health Inc fell after the insurer’s strong quarterly profit failed to ease investor concerns over regulatory hits to the company’s government-backed insurance business.

Elsewhere in healthcare, Abbott Laboratories shares jumped after the medical device maker said most delayed non-urgent medical procedures had resumed globally three years into the COVID-19 pandemic. Intuitive Surgical shares soared after its quarterly revenue and profit topped estimates.

Shares of Western Alliance Bancorp surged after the company posted stronger-than-expected earnings, helping lift the SPDR S&P Regional Banking ETF.

Regional banks have been in focus after the failure of Silicon Valley Bank last month prompted concerns about systemic risks. (Reporting by Lewis Krauskopf in New York, Sruthi Shankar and Ankika Biswas in Bengaluru Editing by Vinay Dwivedi and Richard Chang)

Add Comment