Warren Buffett has an enviable long-term record in the stock market, although in recent years his performance has been less impressive.

Lately some newer investors in the momo (momentum) crowd that’s controlling this stock market have criticized Buffett. However, Buffett’s latest move shows that he is as sharp as ever.

Buffett has not been a fan of gold. As a matter of fact, he has often derided the precious metal. To the dismay of gold bugs, Buffett has been the de facto leader of the anti-gold crowd. There has been a belief that investing in gold was akin to betting against America.

Read:Did Warren Buffett just bet against the U.S. economy? His latest investment raises questions

Buffett deserves credit for shifting his stance to the new reality as a result of the irrational policies of massive borrowing and money printing by U.S. leaders. Berkshire Hathaway BRK.A, -1.80% bought about 21 million shares of gold miner Barrick Gold GOLD, +11.70%, spending about $563 million. That’s according to a filing released Aug. 14.

Buffett’s conversion to gold is a signal for other stock market investors.

Let’s examine this issue.

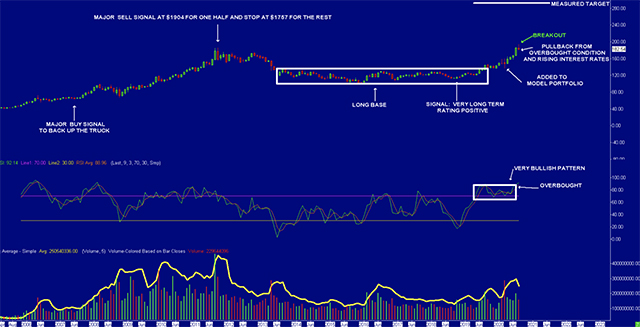

Gold has no earnings and does not pay a dividend. In analyzing gold, a chart is your best friend. Above is an annotated chart of SPDR Gold Shares GLD, +2.14%, an exchange traded fund. You may have to enlarge the image.

Note the following:

• The chart is monthly, giving investors a long-term perspective.

• Gold traced a very long base. The longer the base, the more important the move.

• Gold broke out from a technical perspective.

• After the breakout, gold pulled back. This is a normal behavior because gold was very overbought going into the breakout.

• An important factor behind the pullback in gold is the rise in interest rates. Interest rates rose from the recent low of 0.51% to about 0.71%. When interest rates are low, gold does not like higher interest rates. Interest rates will continue to be one of the biggest determinants of how gold moves.

• Notice the pattern traced by RSI (relative strength index). This is a bullish pattern for the long term.

• Gold is priced in U.S. dollars. Lately the U.S. dollar has weakened and this has benefited gold. However, the weak dollar has become a crowded trade and is now technically oversold. For this reason, there is a setup for the dollar to move higher in the short term. A rise in the dollar will put pressure on gold to the downside.

• The policies of the U.S. government to borrow heavily and for the Federal Reserve to keep on printing money are not likely to change. Policies of central banks and governments across the globe are similar. These policies are the main driver behind gold’s rise and perhaps the reason behind Warren Buffett’s change of heart.

• Due to the policies of governments and central banks, investors may want to develop the habit of watching the price of gold just like they watch stock indexes.

• Gold is a very small market compared with the stock market. Even a small amount of inflows into gold from large-cap tech stocks may cause a big spike in gold.

• Any big move up in gold may be positive for bitcoin BTCUSD, +4.33%.

Warren Buffett, CEO of Berkshire Hathaway

AP

Buffett’s purchase

Even though the media is hyping Buffett buying gold, the investor actually purchased a gold miner with the symbol “GOLD” (Barrick Gold). The company pays a dividend.

There is merit to buying gold stocks. However, there is too much hype around Barrick Gold because of Buffett’s purchase. Investors may consider large-cap gold stock Newmont Corp. NEM, +7.04% instead of Barrick Gold. Both Barrick Gold and Newmont are on our recommended list of gold stocks. Other gold stocks on our recommended list are IAMGOLD Corp. IAG, +6.39%, Yamana Gold AUY, +7.58%, Royal Gold RGLD, +4.64%, Agnico Eagle Mines Ltd. AEM, +4.40% and Franco-Nevada Corp. FNV, +3.72%. There are also silver mining stocks on the list.

Arbitrage trade

In addition to long-term investments in gold, silver and precious metal stocks, short-term trading opportunities abound. For example, right now there is a short-term trading opportunity to buy Newmont and short-sell Barrick Gold. This is an arbitrage trade for those with the knowledge to take advantage of the move up in Barrick Gold stock due to Buffett-related hype.

Buffett betting against America

Much has been said in the media about Buffett betting against the American economy by selling banks and buying Barrick Gold. Buffett has been selling J.P. Morgan Chase JPM, -2.62% and Wells Fargo WFC, -3.28%. Two important points are worth noting:

• Barrick Gold is a very small position for Buffett relative to his total portfolio.

• Buffett has been buying Bank of America BAC, -2.15%.

Caution

Several points of caution are in order including, but not limited to, the following:

• Gold is volatile and should be bought when it falls into the buy zone.

• Gold stocks are significantly more volatile than gold. However, they present a more lucrative opportunity. These stocks should be bought by scaling in the buy zones.

• If interest rates rise, gold may fall.

• If the dollar rises, gold may fall.

• Gold is often sold at times of distress in the stock market as investors sell anything they can to meet margin calls.

• Central banks hold large amounts of gold. It is conceivable that central banks may start selling their gold.

• Gold is a small market and can be easily manipulated by governments.

Disclosure: Arora Report portfolios have positions in SPDR Gold Shares GLD, +2.14%, Newmont, Barrick Gold, IAMGOLD Corp., J.P. Morgan and Bank of America. Nigam Arora is the founder of The Arora Report, which publishes four newsletters. He can be reached at [email protected].

Add Comment