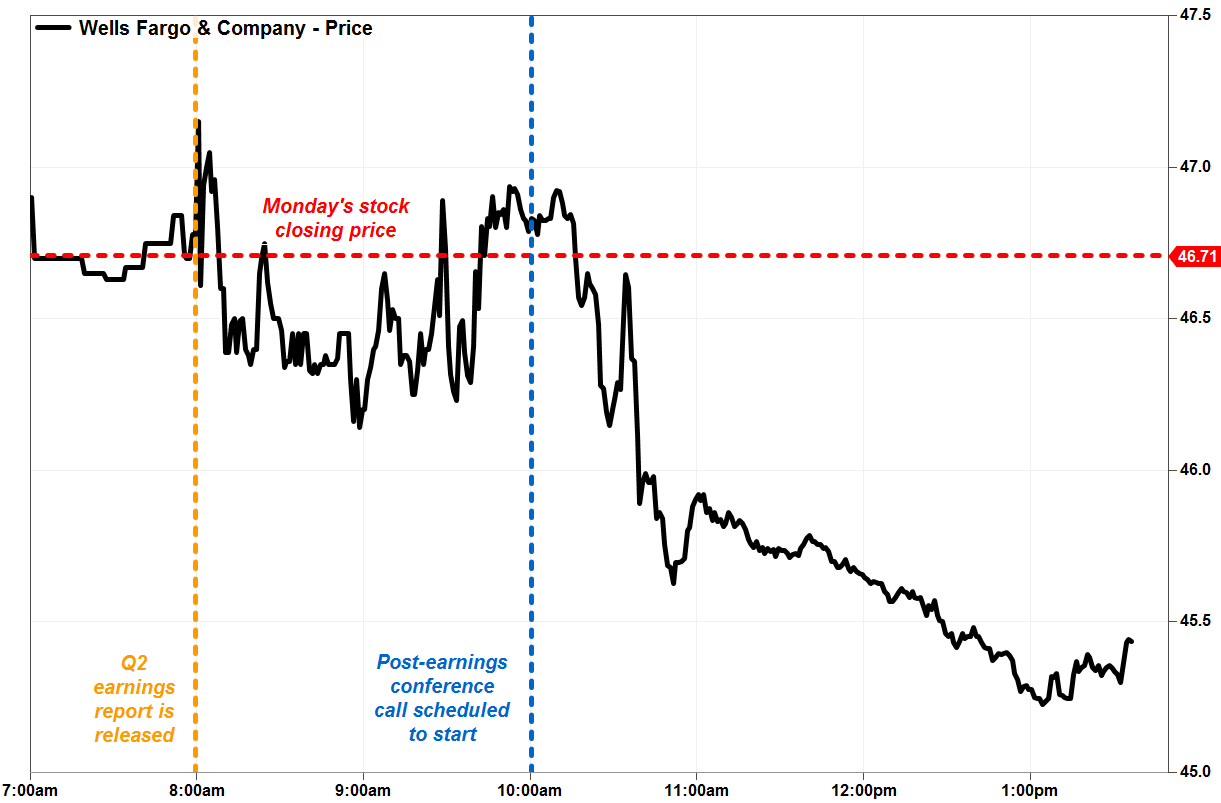

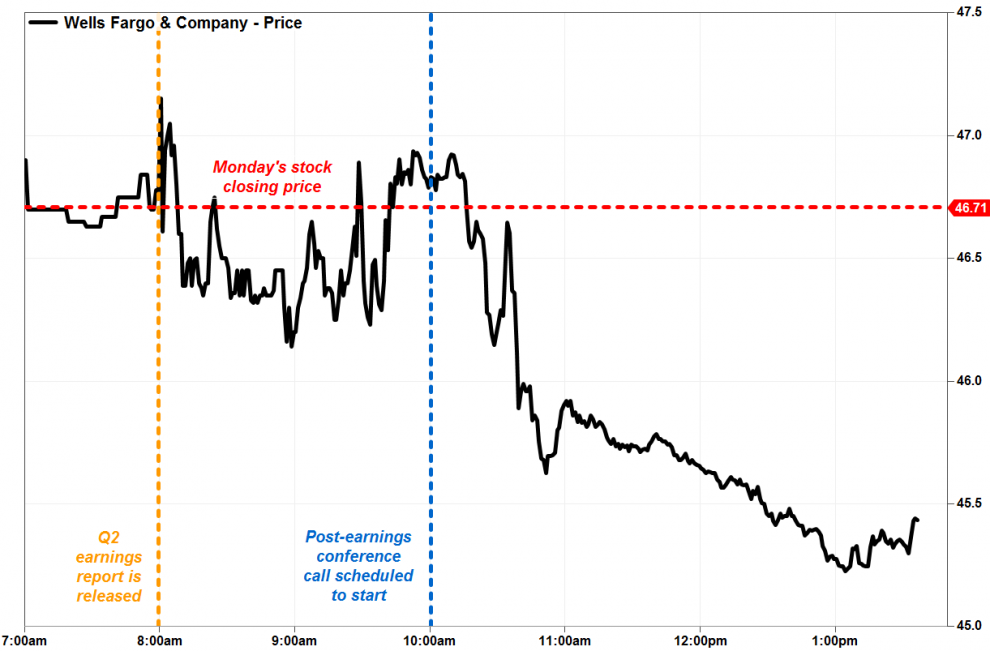

Shares of Well Fargo & Co. fell Tuesday after yet another disappointing earnings report and conference call with analysts, as downbeat guidance on net interest income and expenses, and still no word on a new chief executive, overshadowed profit and revenue beats.

The stock WFC, -3.05% slumped 2.7% in afternoon trading, while shares of other major banks that reported earnings rallied.

Wells shares have now fallen on the day results were reported for the past three quarters, and on nine of the past 10 quarters, and 17 of the past 20. Read more about the stock’s sharp U-turn last quarter after an NII warning.

Earlier, the bank reported second-quarter net income of $6.2 billion, or $1.30 a share, in the second quarter, up from $5.2 billion, or 98 cents a share, in the year-earlier period, to beat expectations of $1.30 a share, according to FactSet. Revenue was unchanged at $21.6 billion but was above expectations of $20.9 billion.

Net interest income (NII) fell 3.6% to $12.10 billion, to miss the FactSet consensus of $12.20 billion.

On the post-earnings conference call with analysts, Chief Financial Officer John Shrewsberry said 2019 NII is now expected to decline by nearly 5%, according to FactSet, compared with the guidance provided three months ago of down 2% to 5%, given the change in the interest rate environment.

FactSet, MarketWatch

FactSet, MarketWatch

The new NII outlook includes hawkish expectations for “1 to 2” interest rate cuts by the Federal Reserve this year. That’s less than consensus expectations, in which fed funds market pricing implies a more than 50% chance that the Fed will cut rates by 75 basis points (0.75 percentage points) through December, via three cuts of 25 basis points each.

In comparison, JPMorgan Chase & Co. CFO Jennifer Piepszak said the bank’s lowered outlook for full-year NII to $57.5 billion from “$58-plus-billion” assumed up to three interest rate cuts.

See related: Fed’s Powell says trade worries retraining the economy, hints at interest-rate cuts soon.

J.P. Morgan’s stock JPM, +1.31% rose 0.7% in afternoon trading and Goldman Sachs Group Inc. GS, +1.66% shares tacked on 1.0% after the investment bank also reported second-quarter results.

FactSet, MarketWatch

FactSet, MarketWatch

Separately, Allen Parker, who has been interim chief executive since March, said 2019 expenses are now expected to be “near the high end” of expectations. Shrewsberry blamed higher-than-expected investments in risk management, including data and technology for the higher expense outlook.

When asked about whether the bank was less confident in its previous guidance that 2020 expenses would be lower than 2019, Shrewsberry said 2020 expenses was “reforecasted” to be “relatively flat” with 2019.

And last but not least, Parker said the bank would hold off on establishing strategic and financial targets beyond 2019 until a permanent CEO was in place. The search for a new CEO, which is now approaching four months, remained a “top priority,” Parker said, but he still offered no insight on timing.

“While there has been and will continue to be much speculation in the media and otherwise, regarding the search, the board and search committee do not plan to provide updates on their progress until they’ve made a final selection,” Parker said. “Accordingly, we don’t have any additional information to provide.”

The media speculation Parker referred to likely includes a report in The Wall Street Journal that the bank was having trouble recruiting top bankers, as two of its preferred candidates turned down approaches.

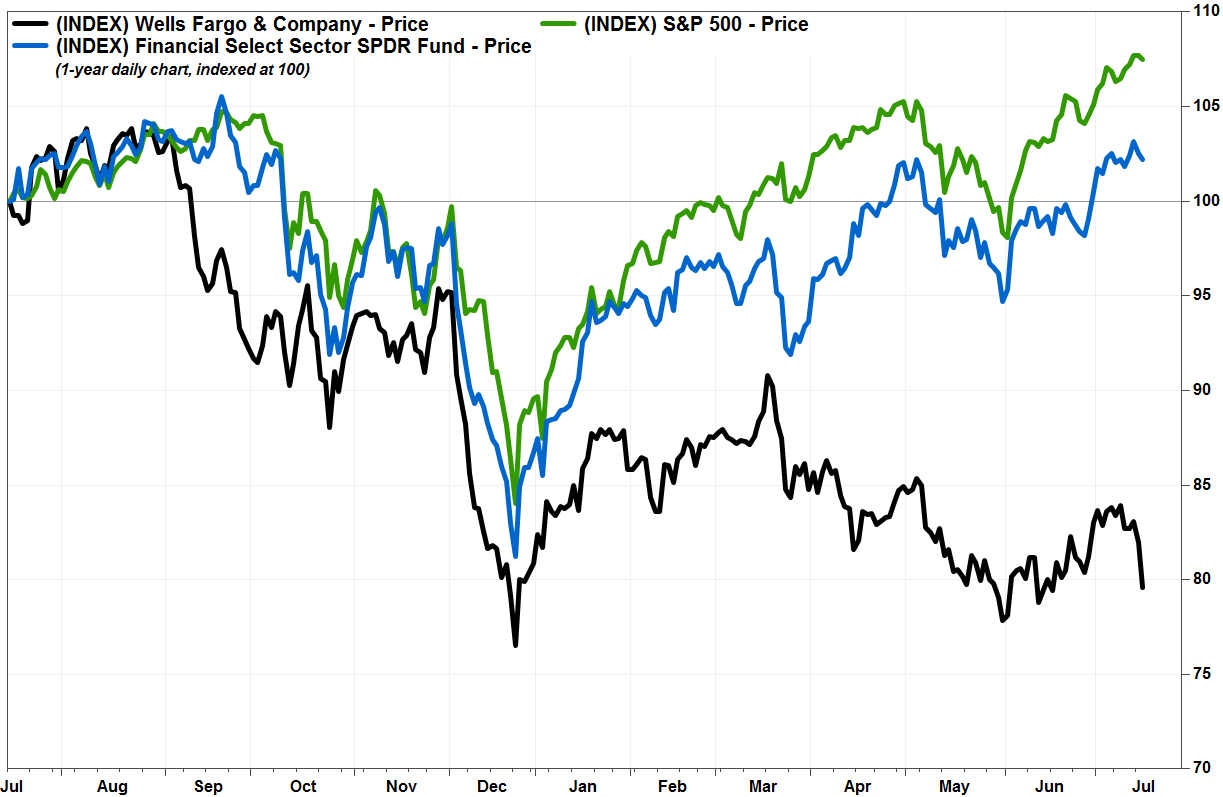

Wells Fargo’s stock has lost 1.4% year to date, while the SPDR Financial Select Sector exchange-traded fund XLF, -0.16% has climbed 17.9% and the S&P 500 index SPX, -0.28% has rallied 19.8%.

Add Comment