It’s conventional wisdom that when stock markets swoon, investors flock to the safety of U.S. Treasury securities.

That’s not the case anymore, according to a study released on Monday by the Bank for International Settlements.

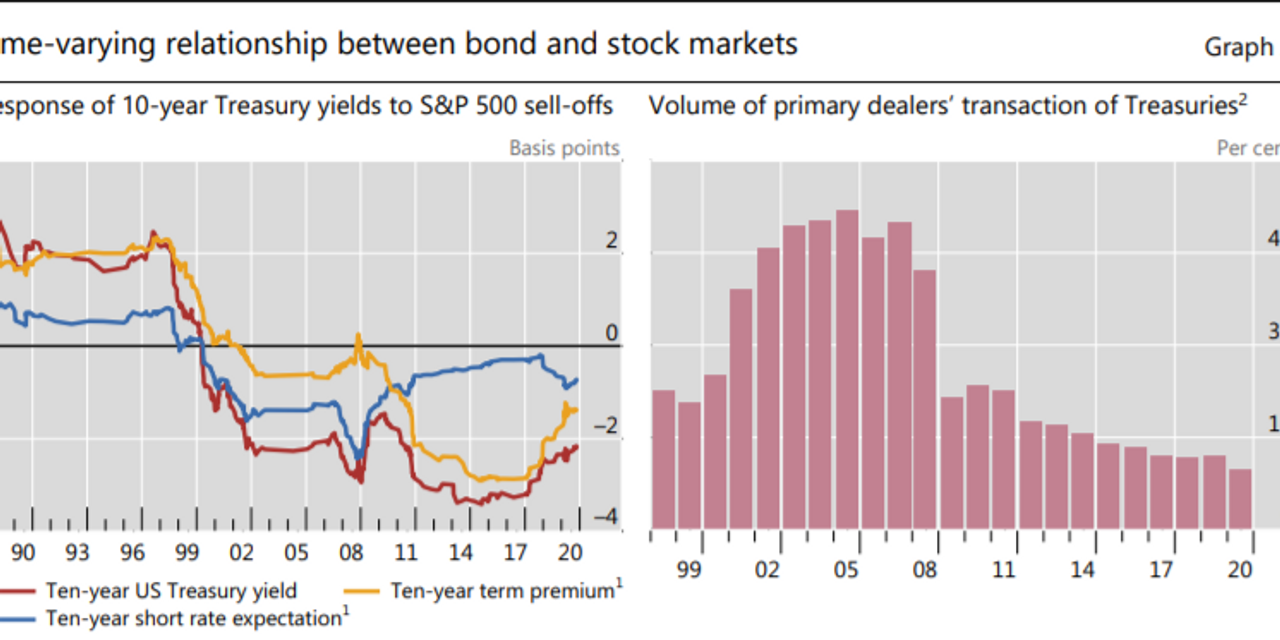

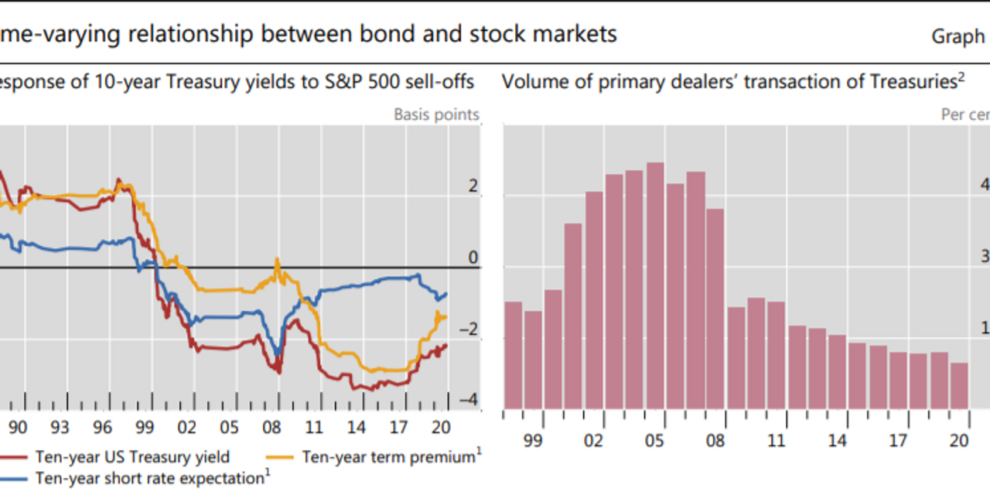

As part of its quarterly review, the BIS studied the response of 10-year Treasury yields TMUBMUSD10Y, 0.934% to S&P 500 SPX, -0.19% selloffs. Before the 2000s, the yield on the benchmark government bond tended to rise by 2 basis points when the S&P 500 fell by 1%. That is, stocks and bonds fell together.

After 2000, Treasurys did become an effective hedge to stock market losses, as yields declined during equity market downturns.

But over the last two years, that relationship is starting to ebb, the BIS found. The response of 10-year yields to S&P 500 selloffs has become more muted since 2018, which the BIS postulated could be because of the limited easing space available for the Federal Reserve.

Another factor behind the faltering relationship could reflect the declining appetite of dealers to intermediate. As banks lessened their involvement in the bond market after the 2008 financial crisis, hedge funds and principal trading firms have largely taken their place — but they are behaving in a more opportunistic manner, being less willing to step in when liquidity is needed.

Add Comment