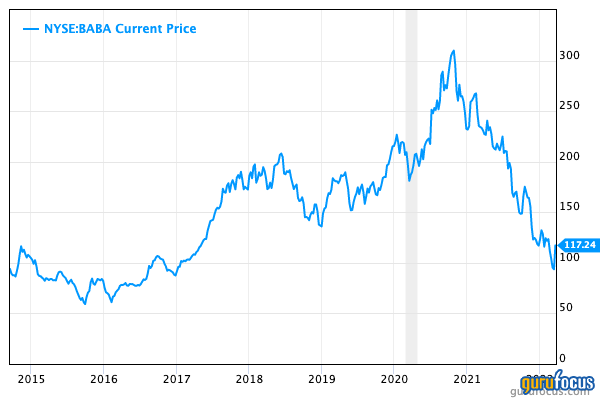

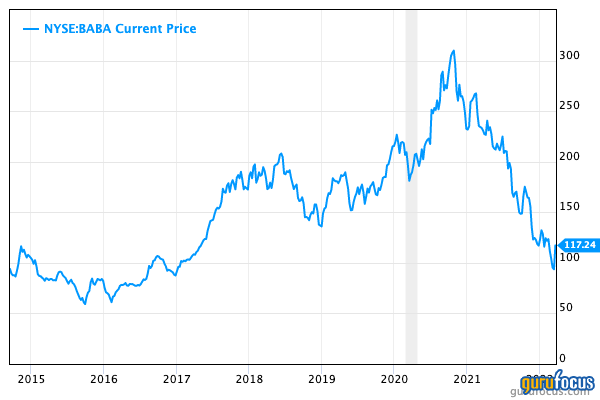

Alibaba (NYSE:BABA), the leading Chinese e-ommerce and cloud computing giant which has been dubbed the Amazon (NASDAQ:AMZN) of China,” has been all over the news lately as regulatory headwinds seem to be abating. This has caused the stock price to recover 25% over the past week after a 61% decline from October 2021 highs.

To recap, the firm came under intense scrutiny by Chinese regulators and was fined $2.8 billion in 2021 in a landmark antitrust case. The outspoken founder Jack Ma even went missing for a period of time, after his outspoken comments criticizing the Chinese regulatory environment. At one point, Alibabas share price was down by as much as 72% and reached a low of $86 per share, the same price as in 2016. This was driven not only by the Chinese crackdown on big tech but also by the U.S. legislation threatening to de-list shares and also, to a lesser extent, inflation.

Then, as if things couldnt get worse for the stock, they issued a serious profit warning, though management insisted this is a short term issue.

Since then, though, some good news has finally hit the company. China’s state media released a positive statement regarding the tech crackdown. They stated that The Chinese government continues to support various kinds of businesses overseas listings, and that regulators should complete as soon as possible the crackdown on the large internet companies such as Alibaba, Tencent (TCEHY) and Baidu (BIDU).

Alibaba also announced good news on Tuesday, stating that they will increase their share buyback program from $15 billion to $25 billion for up to a two year period. Due to his week’s good news, the stock has bounced back by 25%.

In this article, I’m going to take a deep dive into if Alibaba’s stock is still undervalued. While some positive news has surfaced, the stock has still issued a serious profit warning, and the risk of the U.S. de-listing share of foreign companies is still present.

Financial analysis

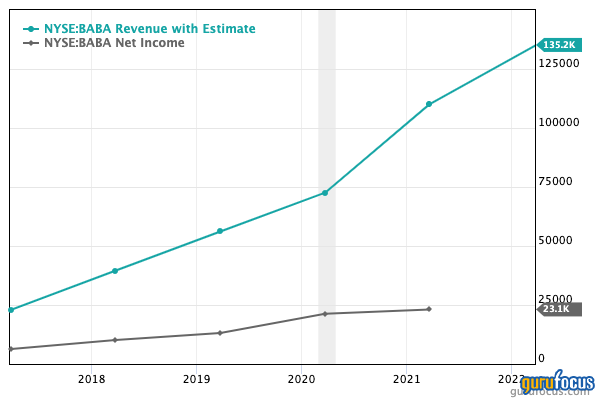

Alibaba has been growing revenues at a tremendous 42% compound annual growth rate (CAGR) over the past three years. For the fourth quarter of 2021, revenue was $38 billion, an increase of 10% year over year, which was driven by:

-

China commerce segment revenue +7% year-over-year to $27 billion

-

Cloud segment +20% year-over-year to $3 billion

-

Local consumer services segment +27% year-over-year to $1.9 billion

-

International commerce segment +18% year-over-year to $2.5 billion

However, the company’s operating income did take a major hit in the quarter with an decrease of 86%. This included a $3.9 billion impairment of goodwill related to the digital media and entertainment segment. Excluding this, income from operations would have been $5.054 billion, a decrease of 34% year-over-year. This decline was primarily due to the company’s increased investments in growth initiatives and increased spending for user growth, as well as merchant support, according to Alibaba.

Is the stock still undervalued?

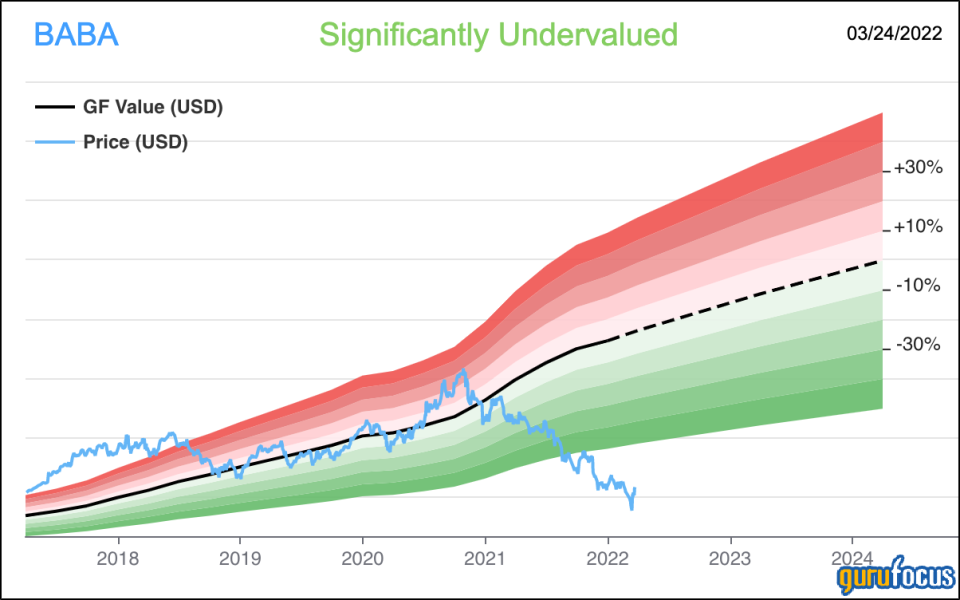

In order to value Alibaba’s stock, I have plugged the latest financials into my discounted cash flow model. I have estimated 10% revenue growth for the next five years, and I expect the operating margin to increase back to prior levels of 23%, which is the same as the levels in 2019.

Given these assumptions, I get an estimated fair value per share of $196. The stock is currently trading at just $114 even after the rebound. Thus, the stock is 42% undervalued without considering the regulatory risk.

The GF Value Line, a unique intrinsic value estimate from GuruFocus, rates the stock as significantly undervalued.

Final thoughts

Alibaba is a fantastic company and a true leader in e-commerce and coud. I estimate that the stock is about 42% undervalued without taking the regulatory risk into consideration. Whether the stock is truly undervalued or not really depends on the regulatory situation, with is the reason why the market is still steeply discounting the stock. If the U.S. decides to de-list Alibaba, shareholders of the U.S. listing could lose everything. However, China’s regulators seem to be optimistic on resolving these issues, and Wall Street is also mostly against de-listing foreign stocks.

This article first appeared on GuruFocus.

Add Comment